There’s no doubt that over the past few years, emerging technologies have been paving the way for innovative physical security applications. Branch innovation has been a trending topic within the retail banking segment, but it can mean different things to different departments within a financial institution.

For most physical security managers, branch innovation is commonly seen as the ability to leverage new technology to better optimize their security teams and to enhance or improve business operations. There’s also a desire with many financial institutions to attract, measure and enhance the overall customer experience.

Many banks and credit unions are looking for the latest physical security technology as they seek to upgrade aging systems. The current challenges for many institutions are, first, quantifying and qualifying their needs and challenges, and, second, determining the best available technologies that will meet most of those needs while providing the best long-term value or ROI for their organization.

Extra Point:

An unexpected banking application of AI is in video surveillance, which can impact not only security but operational intelligence.

A surprising solution in this quest for branch innovation has been the use of network video camera systems. With the maturity of sophisticated edge-based video analytics, network cameras have stepped beyond their traditional sphere of security surveillance and loss prevention and into the realm of operational business intelligence. The use of artificial intelligence (AI) is aiding the development of video analytics to improve performance and accuracy in some cases.

Can financial institutions get a return on their investment by leveraging emerging technologies like AI? Absolutely.

How AI Enhances Video Networks

AI-based video analytics is one of the most discussed topics in the video surveillance industry. Some of the applications can substantially speed up data analysis and automate repetitive tasks. But AI solutions today cannot replace the human operator’s experience and decision-making skills. The benefit lies instead in a combination: taking advantage of AI solutions to improve and increase human efficiency.

AI incorporates machine learning algorithms and deep learning algorithms. Both automatically build mathematical models, using substantial amounts of sample data (training data), to gain the ability to calculate results without being specifically programmed for it. An AI algorithm is developed through an iterative process, in which a cycle of collecting training data, labeling training data, using the labeled data to train the algorithm, and testing the trained algorithm, is repeated until the desired quality level is reached.

After this, the algorithm is ready to use in an analytics application that can be purchased and deployed on a surveillance site. At this point, all the training is done, and the application will not learn anything new.

Keep in Mind:

As AI is increasingly applied in surveillance, the advantages of operational efficiency and new use cases must be balanced with a mindful discussion about when and where to apply the technology.

Video Analytic Use Cases

While traditional retailers have been incorporating video analytics into their daily operations for some time, financial institutions have lagged well behind the technology curve. But this cautious, wait-and-see attitude is starting to wane as more financial institutions begin to appreciate the value of business intelligence that video analytics can provide.

The variety of specialized video analytics is quite broad and continues to expand with more applications being introduced to the market every year. On the surface, many appear to be security-oriented, but with a little creativity can be applied to operational situations as well. Here are several applications.

Facial capture

This advanced analytic captures, indexes and catalogs the faces of people entering the branch or using the drive-through teller. Powerful search algorithms enable financial institutions to quickly find the recorded video of individuals of interest to expedite investigations of fraud, robbery or identity theft.

With facial capture analytics banks and credit unions can build stronger cases to submit to law enforcement and better protect assets by setting alerts for suspects using facial similarity searches.

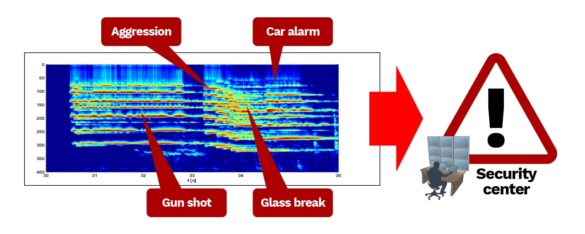

Sound detection

This camera-based analytic provides the ability to detect specific sounds and send alerts when they are detected. There are several options such as aggression, car alarm, gunshot and glass break detection. The ability to get accurate advanced alerts allows for proactive event analysis by security staff.

License plate recognition

This analytic automatically captures the license plate in real time, compares or adds it to a pre-defined list, and then takes appropriate action such as generating an alert. Captured plate data can be used to identify motorists at drive-through teller stations and ATMs as well as for parking lot security, and more. The analytics can also capture additional forensic detail like the make, model and color of the vehicle and, in some cases, an image of the driver.

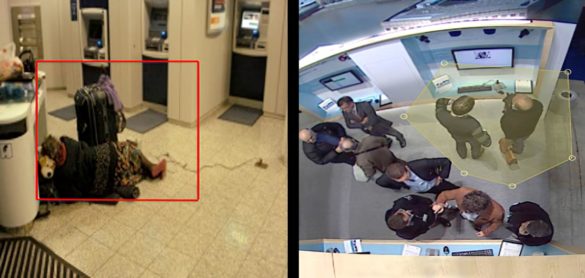

Loitering or vagrancy

This video analytic can be used to detect people that enter a specific area and send an alert if they remain in that area for a predetermined amount of time. For ATM vestibules, this can help to prevent people from hanging out in these areas creating a potentially unsafe or undesirable environment for customers.

Addressing Issues in a Retail Branch Environment

Analytics can be very powerful tools to help banks and credit unions maximize value from their network video systems and gain deeper insight into their business. In some cases, these solutions may already exist but aren’t being utilized to their full potential. Several years ago, some of the use cases above may not have provided consistent results but the introduction of AI by some analytic solution providers is showing marked improvements in performance and accuracy.

It’s important that physical security managers who are considering migrating to this new technology share with their operations team how they, too, can profit from these tools to help improve security and safety as well as additional benefits such as mask detection.

As financial institutions strive to be innovative, gathering valuable real-time performance data will be critical to achieving business optimization. Strategic use of video analytics will help not only leverage resource spending but will speed the process of making important business decisions.

For more information on AI and video analytics, reach out to Stephen Joseph, Segment Development Manager, Banking and Financial Sector, Axis Communications.

Contact for details.